@ShahidNShah

While a cautious optimism prevails, several factors suggest that 2024 could be a dynamic year for healthcare M&A.

Read on hitconsultant.net

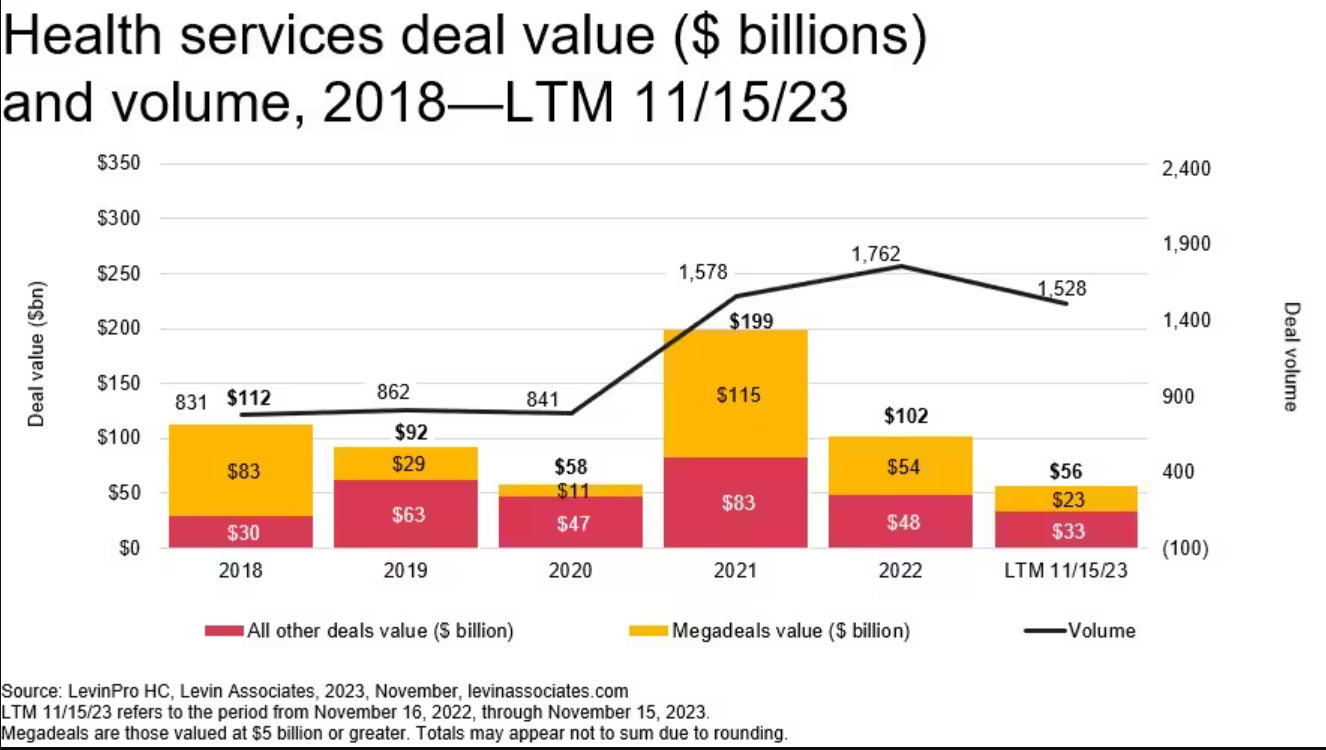

In 2024, PwC's Health Services Deals Outlook presents a cautiously optimistic view of healthcare mergers and acquisitions (M&A), despite a 13% decline in deal volume compared to the previous year. Key points from the outlook include:

Cautious Optimism: Despite the decline in deal volume, there is a sense of cautious optimism for the healthcare M&A landscape in 2024. Adaptability, resourcefulness, and a focus on value creation are deemed essential for navigating the evolving environment.

Factors Fueling M&A Activity:

Beyond Volume:

Key Drivers:

Challenges to Navigate:

Continue reading at hitconsultant.net

In the ever-evolving world of healthcare, the role of nurses continues to expand and adapt. This transformation is particularly evident in the realm of nursing education, where technology is playing …

Posted Dec 28, 2023 Nursing Care

Connecting innovation decision makers to authoritative information, institutions, people and insights.

Medigy accurately delivers healthcare and technology information, news and insight from around the world.

Medigy surfaces the world's best crowdsourced health tech offerings with social interactions and peer reviews.

© 2025 Netspective Foundation, Inc. All Rights Reserved.

Built on Apr 17, 2025 at 6:07am