@ShahidNShah

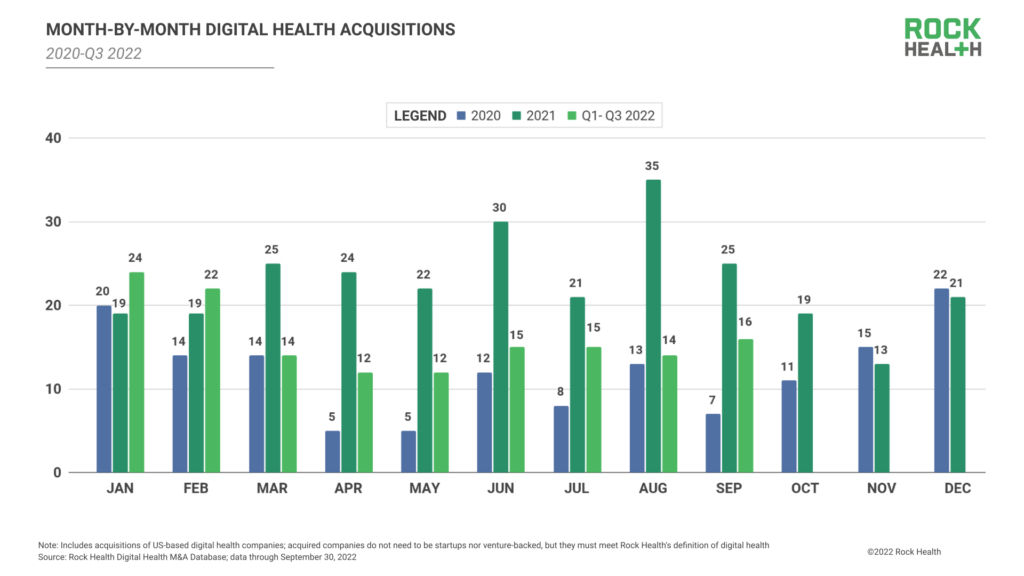

The market's stormy waters have caused a considerable delay in investment in digital health, but both buyers and builders are grabbing the opportunity to look at mergers and acquisitions (M&A) as strategic opportunities. In their most recent study, Rock Health delves into four M&A strategies that acquirers are pursuing at the current market moment, as well as the sell-side and buy-side factors that are creating conditions favourable for M&A activity. Similar to the overall funding situation, digital health M&A exploded in 2021, averaging roughly 23 deals per month for a yearly total of 273 agreements. This trend persisted throughout the first two months of 2022, with January and February 2022 averaging 23 deals monthly.

Continue reading at hitconsultant.net

According to a research by Chartis and Kythera Labs of millions of claims between 2020 and 2022, telehealth currently represents 10% of all outpatient visits, up from 1% before the pandemic, …

Posted Nov 12, 2022 Healthcare Delivery Telehealth

Connecting innovation decision makers to authoritative information, institutions, people and insights.

Medigy accurately delivers healthcare and technology information, news and insight from around the world.

Medigy surfaces the world's best crowdsourced health tech offerings with social interactions and peer reviews.

© 2025 Netspective Foundation, Inc. All Rights Reserved.

Built on Apr 17, 2025 at 6:07am